Strengthening Rural Industries to Boost Income Growth in Guizhou Province, the People’s Republic of China

BEIJING, PEOPLE’S REPUBLIC OF CHINA (4 December 2025) — The Asian Development Bank (ADB) and Shouguang Luli Wood Inc. (Luli Wood) have signed a $50 million green loan (about CNY353.63 million) to support the construction of an oriented strand board (OSB) factory, associated facilities, and a captive biomass power plant, as well as to finance working capital needs in Jiangxi Province, the People’s Republic of China (PRC).

“Climate stability and healthy natural ecosystems are fundamental global public goods, and this project is a tangible example of how the private sector can be catalyzed to actively safeguard them,” said ADB Country Director for PRC Asif Cheema. “By championing a circular bioeconomy, we are not only reducing emissions and preserving forests but also setting a new benchmark for the forestry sector—demonstrating that commercial viability and environmental stewardship are mutually reinforcing.”

The supply of wood and raw materials in the PRC faces significant challenges, with only 1% of forests certified as sustainably managed. This is compounded by the heavy reliance on imported wood, which accounts for over half of the PRC’s demand. The wood panel market is dominated by plywood, which typically depends on large timbers, encouraging the logging of old and natural forests and the inefficient use of trees.

Luli Wood’s OSB production addresses these challenges. OSB is an engineered wood panel that does not use old-growth timber. It uses wood waste—such as branches and twigs—and small trees sourced from smallholder farmers, with about 10% of the inputs being fast-growing and sustainable bamboo. The waste generated from the OSB production is used as fuel by a biomass power plant, which generates the electricity and steam required to operate the factory.

ADB’s financing is verified as a green loan by ERM, a second-party opinion provider, in accordance with the Green Loan Principles.

The project is expected to reduce greenhouse gas emissions by around 200,000 tons of carbon dioxide annually, create 1,500 jobs, and provide additional income for thousands of smallholder wood suppliers. The project also incorporates a gender action plan that will increase women’s inclusion across Luli Wood’s value chain, operations, and workplace.

“Partnering with ADB is a powerful endorsement of our vision,” said Luli Group Vice Chairman Xue Mingliang. “We have built a fully integrated, green supply chain—from sustainable forestry to finished homes—and are committed to setting a new standard for the industry. This collaboration is a pivotal step in our journey to becoming an international company in sustainable wood processing.”

Established in 2001, Luli Wood is a subsidiary of the diversified Luli Group and one of the largest OSB producers in the PRC. The company holds chain-of-custody certifications from both the Forest Stewardship Council (FSC) and the Programme for the Endorsement of Forest Certification (PEFC). These certifications ensure traceability and responsible sourcing from forest to finished product, validating that raw materials originate from certified forests or recycled materials. Luli Group is ranked among the top 500 private companies in the PRC.

ADB is a leading multilateral development bank supporting inclusive, resilient, and sustainable growth across Asia and the Pacific. Working with its members and partners to solve complex challenges together, ADB harnesses innovative financial tools and strategic partnerships to transform lives, build quality infrastructure, and safeguard our planet. Founded in 1966, ADB is owned by 69 members—50 from the region.

Reproduced from ADB.org.

BEIJING, PEOPLE’S REPUBLIC OF CHINA (1 December 2025) — The Asian Development Bank (ADB) has approved a loan of CNY755.64 million ($106.05 million equivalent) to support the development of green, smart, and resilient inland river ports and clean-energy shipping in Anhui Province of the People’s Republic of China (PRC).

The Anhui Province Green Port and Shipping Demonstration Project will help transform the local port and shipping sector into a more sustainable and digitally advanced model. The project aims to reduce greenhouse gas emissions, enhance resilience to extreme weather events, and strengthen logistics connectivity to support inclusive and sustainable economic growth. It will directly benefit an estimated 1.17 million residents—including women, low-income groups, and persons with disabilities—through improved transport efficiency, reduced logistics costs, and increased employment opportunities.

“This project demonstrates the powerful impact of integrating low-carbon transport with smart and green port development,” said ADB Country Director for the PRC Asif Cheema. “Aligned with both the country’s goal for high-quality, low-carbon development and ADB’s country partnership strategy for the PRC, 2021–2025, the project will contribute to regional and global public goods, including reduced greenhouse gas emissions and more sustainable logistics systems.”

Anhui’s rapid industrial growth, including its booming electric vehicle sector, has boosted freight demand. However, inland waterways and ports face capacity constraints, diesel vessel dominance, and climate hazards—such as flooding and extreme storms—that threaten service continuity. These challenges increase logistics costs, raise emissions, and heighten the vulnerability of riverside communities.

To address these issues, the project will construct green and climate-resilient inland river ports equipped with energy-efficient loading facilities, smart port operation systems, and robust flood protection mechanisms. Clean-fuel container vessels will replace diesel-powered ships and pilot green shipping routes connecting key logistics hubs. The project will enhance emergency preparedness and promote gender-inclusive employment in port operations, with women expected to fill at least 15% of skilled positions.

The project will further strengthen institutional capacity through studies on expanding the use of clean and alternative fuels. It will develop green and smart port management guidelines and deliver targeted training on climate resilience and sustainable finance. It will also share knowledge generated with other provinces and ADB developing member countries to promote low-carbon inland waterway transport and green port development.

ADB is a leading multilateral development bank supporting inclusive, resilient, and sustainable growth across Asia and the Pacific. Working with its members and partners to solve complex challenges together, ADB harnesses innovative financial tools and strategic partnerships to transform lives, build quality infrastructure, and safeguard our planet. Founded in 1966, ADB is owned by 69 members—50 from the region.

Reproduced from ADB.org.

Trade between Kazakhstan, Kyrgyz Republic, and the People’s Republic of China (PRC) has traditionally been viewed through the lens of high-level agreements and major industries. However, a closer look highlights the crucial role of small and medium-sized enterprises (SMEs) as the driving force behind this trade.

While traditional cross-border commerce remains dominant, the growth of e-commerce has introduced both opportunities and challenges for SMEs. Given their substantial contributions to gross domestic product—36.5% in Kazakhstan and 43.3% in Kyrgyz Republic—these businesses are well-positioned to capitalize on expanding trade with the PRC. As a global leader in cross-border e-commerce, PRC has significantly influenced these evolving trade dynamics.

A study published by the Central Asia Regional Economic Cooperation (CAREC)[1] Institute analyzes the key drivers of trade between Kazakhstan, Kyrgyz Republic, and the PRC from the perspective of businesspeople. Special attention is given to the role of the Xinjiang Uyghur Autonomous Region in this trade, considering its historical, cultural, religious, and ethnic ties with Kazakhstan and Kyrgyz Republic.

Qualitative interviews with entrepreneurs from Kazakhstan and Kyrgyz Republic involved in cross-border trade with the PRC revealed that Central Asian companies use five strategies in their trade with the PRC:

The adoption of these strategies depends on the company’s size, industry, and access to resources. Larger firms with greater financial and logistical capabilities are more likely to diversify their approaches to maximize their competitive advantage by combining direct trade with factories and e-commerce. In contrast, smaller SMEs may focus on one or two strategies due to resource constraints, often relying on intermediaries or localized trade networks. This strategic diversity highlights the adaptability of Central Asian businesses in navigating the complexities of trade with the PRC.

Lack of interest in factories. Businesses in Kazakhstan and Kyrgyz Republic show little interest in Urumqi’s (northwestern PRC) factories, which produce limited goods. Entrepreneurs who come to Urumqi deal with companies’ representatives operating from warehouses near wholesale bazaars. The product range presented by these companies is usually limited and delivered to Urumqi at a higher price. For Central Asian entrepreneurs who have only started doing their businesses in Urumqi, local representatives (local Uyghurs, Kazakhs, and Kyrgyz, known as pomogaiki) provide services such as supplier searches, translation, and negotiations, and charge 100–200 yuan per day or take a 20% commission on purchases.

High markups. Majority of goods delivered to Central Asian markets from the PRC, have a substantial markup, several times higher than the original price charged by the supplier. For example, fabrics at Madina Bazaar in Kyrgyz Republic’s capital, Bishkek, pass through multiple resale stages. This supply chain can involve 5–7 markups. Re-branding and reselling are common not just in textiles but also in other sectors, including equipment, home products, and furniture.

Regulatory barriers. Despite efforts to export local products to the PRC, stringent certification, licensing, and laboratory requirements remain as major obstacles. Attempts of companies in Kyrgyz Republic to sell camel milk, nuts, dried fruits, and licorice on an e-commerce platform have largely been unsuccessful due to certification challenges and unmet volume requirements.

Need for intermediaries. To ensure quality of goods, Central Asian businesses hire intermediaries in the PRC to negotiate and inspect orders, with fees reaching up to 20% of the contract value. Finding reliable intermediaries can be challenging due to market competition and the risk of fraud.

High order volumes. Working with businesses in southern PRC regions is feasible mainly for medium and large enterprises due to high financial commitments, with fabrics are sold in wholesale quantities, far beyond most Kyrgyz Republic producers’ needs. Kyrgyz manufacturers prefer smaller purchases to test the market, avoiding the risk of unsold inventory.

Affordability for SMEs. Trade with Xinjiang is well suited for small-scale businesses. Kyrgyz Republic’s shop owners use industry contacts to send images of needed goods via an app; negotiate prices, quantities, and delivery dates with Urumqi suppliers; and arrange shipments. Transactions are fast and convenient, allowing them to order small quantities to test market demand. If demand grows and funds are available, they can explore other sourcing and delivery channels.

PRC–Kyrgyzstan-Uzbekistan railway. Kyrgyz Republic’s business sector is optimistic about the PRC–Kyrgyz Republic–Uzbekistan railway, especially as it passes through Torugart, a key border crossing. Located near this crossing, Naryn’s Free Economic Zone offers significant opportunities and has the potential to become a logistics and trade hub similar to Khorgos. This would enable businesses to buy Chinese goods and resell them locally at higher profits.

Unlike Khorgos, which is unpopular due to poor infrastructure and unfavorable and unprofitable conditions, Naryn’s duty-free zone is expected to be well received, boosting regional development. Kashgar’s Free Trade Zone in Xinjiang will supply goods like fabrics and fittings, reducing logistics costs and enhancing cooperation. However, development of the railway and Naryn’s FEZ may divert to Kazakhstan trade routes currently passing through Khorgos in Kyrgyz Republic.

Installment payments. Paying sellers in Xinjiang in installments makes it convenient for buyers in Kazakhstan and Kyrgyz Republic to do business. Most transactions occur informally through local intermediaries, who confirm payments with Chinese partners.

Positioning beyond trade. Enhancing Khorgos’ appeal as a shopping and sightseeing destination could attract more visitors and diversify revenue streams. Positioning the free economic zone as a regional trade and cultural exchange hub could strengthen its importance in Central Asia.

The proposed policy actions may guide policymakers, trade facilitators, and business stakeholders seeking to improve the cross-border trade of Kazakhstan and Kyrgyz Republic with the PRC.

While challenges, such as regulatory barriers, logistical bottlenecks, and competition persist, opportunities arising from regional integration, e-commerce, and infrastructure development offer significant potential for growth for Kazakhstan and Kyrgyz Republic’s cross-border trade with the PRC.

Research Fellow, Institute of Public Policy and Administration, University of Central Asia

This article was first published on Development Asia.

Disclaimer: The views expressed in this article are those of the authors and do not necessarily reflect the views of the Asian Development Bank, its management, its Board of Directors, or its members.

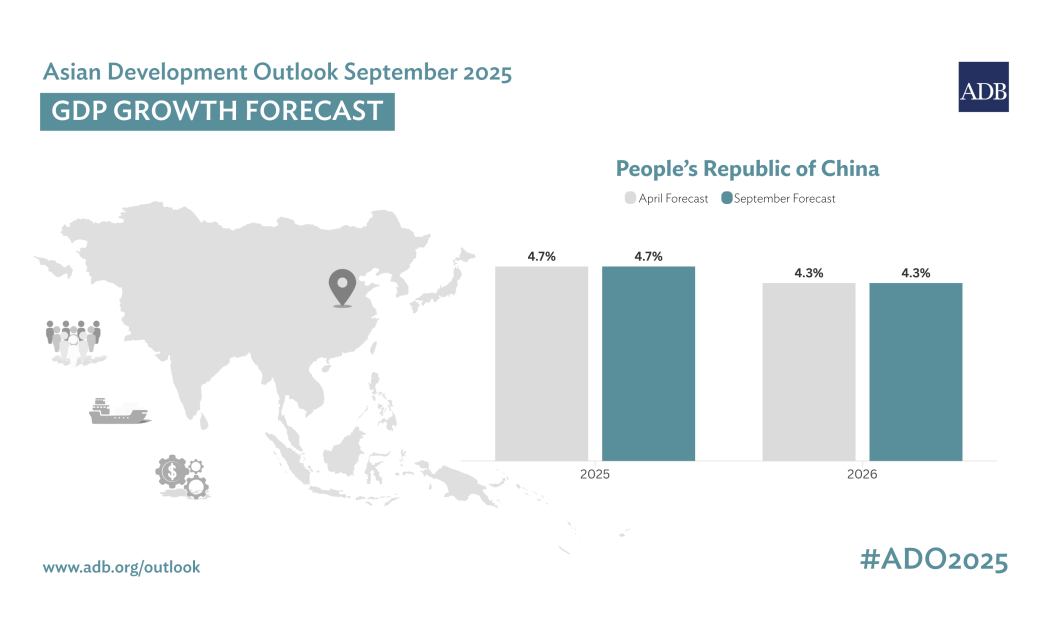

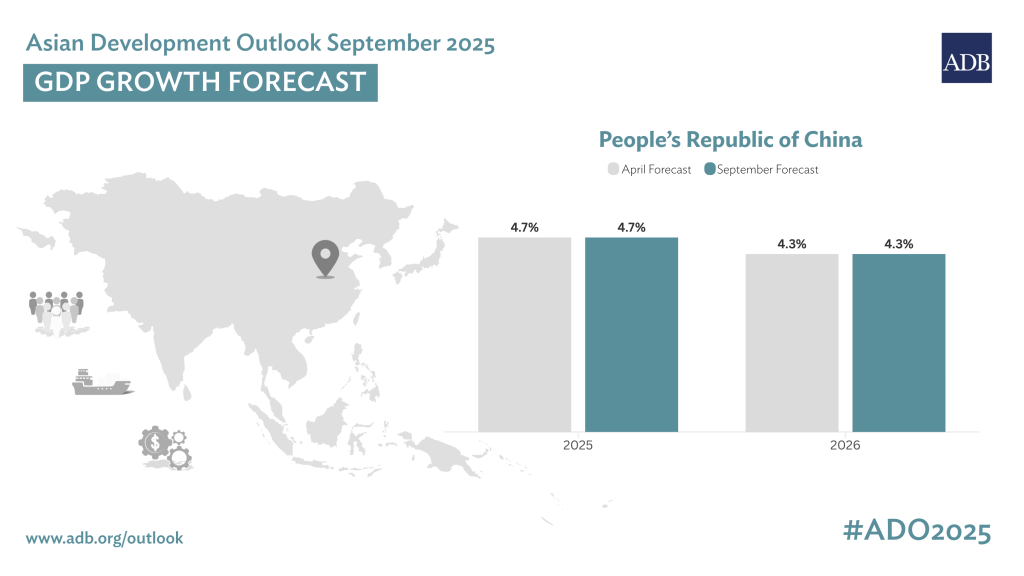

MANILA, PHILIPPINES (30 September 2025) — The economy of the People’s Republic of China (PRC) is forecast to grow by 4.7% in 2025, unchanged from the April projection and close to the government’s target of about 5.0%, according to the Asian Development Outlook (ADO) September 2025 released today by the Asian Development Bank (ADB). Growth is expected to moderate to 4.3% in 2026.

Expansionary fiscal policy, robust industrial activity, and strong exports drove higher-than-expected gross domestic product growth in the first half of 2025. However, the worsened external environment as well as the ongoing property market weakness and subdued household income growth and consumption are expected to continue weighing on growth in the second half of the year and into 2026.

“Policy support, including fiscal expansion and targeted subsidies, has helped sustain growth momentum despite headwinds from the property sector and external trade tensions,” said ADB Country Director for the PRC Asif S. Cheema. “Continued efforts to boost domestic consumption will be crucial for sustaining growth as external uncertainties may weigh on the demand for PRC exports.”

Inflation is now forecast at 0% for 2025 (down from 0.4% in April) and 0.4% for 2026 (down from 0.7%), reflecting continued food price deflation and subdued domestic demand.

Risks to the outlook remain tilted to the downside. Global trade environment and policy uncertainties pose challenges to the growth outlook. Timely implementation of stimulus and reform measures as suggested during the July Politburo meeting remains crucial to effectively offset these possible headwinds.

ADB is a leading multilateral development bank supporting inclusive, resilient, and sustainable growth across Asia and the Pacific. Working with its members and partners to solve complex challenges together, ADB harnesses innovative financial tools and strategic partnerships to transform lives, build quality infrastructure, and safeguard our planet. Founded in 1966, ADB is owned by 69 members—50 from the region.

Lifted from original news article: ADB Maintains China’s 2025 Growth Forecast, Lowers Inflation Outlook

Grasslands are vital ecosystems for both Mongolia and the People’s Republic of China (PRC), supporting biodiversity, climate regulation, and the livelihoods of pastoral communities. However, both countries face increasing pressures from land degradation, desertification, and climate change.

The PRC has implemented a range of large-scale restoration initiatives and ecological compensation schemes, alongside community-based conservation and development practices. These combined top-down and bottom-up approaches have achieved measurable improvements in vegetation cover, ecosystem resilience, and rural incomes. Meanwhile, Mongolia is advancing national strategies through its National Adaptation Plan and investment programs such as the Aimag and Soum Green Regional Economic Development Program, emphasizing grassland ecosystem restoration and sustainable livelihood development for herding communities.

The seminar, held in conjunction with the visit of a high-level Mongolian government delegation to the PRC, aims to deepen knowledge exchange on effective supportive policies, financial mechanisms, and technologies for grassland restoration and sustainable pastoral management. Discussions will draw on lessons from the PRC’s experience at national and subnational levels and explore opportunities for continued knowledge sharing and collaboration.

The delegation visit and seminar are supported by the ADB–PRC Regional Knowledge Sharing Initiative (RKSI), a South–South platform co-hosted by the Ministry of Finance of the PRC and ADB to facilitate knowledge exchange among ADB’s developing member countries. Under RKSI’s umbrella, the Talk China Seminar Series convenes experts and decision-makers to engage on urgent development themes.

Language: Chinese, Mongolian, English (Chinese-Mongolian and Chinese-English interpretation will be provided)

| Date/Time | Session |

|---|---|

| 08:30-08:40 | Welcome remarks Mr. Asif S. Cheema, Country Director, ADB PRC Resident Mission |

| 08:40-08:50 | Sharing I: Green finance to support grassland restoration and management Ms. Yan Wang, Director, Green Finance Division, Research Bureau of the People’s Bank of China (TBC) |

| 08:50-09:00 | Sharing II: Ecological rangeland management Ms. Keyu Bai, Institute of Agricultural Resources and Regional Planning of Chinese Academy of Agricultural Sciences |

| 09:00-09:10 | Sharing III: Ecosystem valuation: eco-compensation mechanisms, gross environment product (GEP), and natural capital Mr. Au Shion Yee, ADB Principal Water Resources Specialist |

| 09:10-09:20 | Sharing IV: Carbon market development and grassland carbon credits Mr. Zhi Cheng, Chief Engineer, Ningxia CDM Service Center |

| 09:20-09:30 | Sharing V: Social capital mobilization for desertification control Ms. Jing Sun, Director of Desertification Prevention and Control, Society of Entrepreneurs and Ecology (SEE) Foundation |

| 09:30-10:30 | Discussions Facilitated by Mr. Aiming Zhou, Deputy Country Director, ADB PRC Resident Mission |

| 10:30-10:40 | Closing remarks

|

ADB’s East Asia Forum (EAF) is an annual event organized by the East Asia Department (EARD) of the Asian Development Bank (ADB). The forum aims to share lessons from ADB’s operations and knowledge work in East Asia—with special emphasis on the People’s Republic of China (PRC)—with a wider audience. In the spirit of South-South learning, the EAF facilitates the exchange of ideas and practices among key stakeholders in Asia and the Pacific. It is supported by EARD-administered technical assistance and various funding sources, including the People’s Republic of China’s Poverty Reduction and Regional Cooperation Fund (PRCF).

The East Asia Forum 2025, with the theme “Advancing High-Quality Development in East Asia: Productivity, Innovation, and Economic Openness,” aims to:

The ADB–PRC Regional Knowledge Sharing Initiative (RKSI) is a South–South platform jointly established by the Ministry of Finance of the PRC and ADB to promote development knowledge exchange among ADB’s developing member countries. As part of its efforts, RKSI organizes the Talk China Seminar Series, a quarterly event that brings together experts and policymakers to explore pressing development issues. The upcoming session- the third in the series- will focus on harnessing artificial intelligence (AI) for high-quality development, featuring expert discussions and field visits to AI sites in Beijing.

Venue: Kerry Hotel, Beijing

| Date/Time | Session | ||

|---|---|---|---|

| 8:30-9:00 | Registration | ||

| 9:00-9:30 | Welcome Remarks Scott Morris, Vice-President (East and Southeast Asia, and the Pacific), Asian Development Bank (ADB) Distinguished Guest Speaker Liao Min, Vice Minister of Finance, People’s Republic of China | ||

| 9:30-9:35 | Photo Session | ||

| 9:35-9:50 | Setting the Stage: Enhancing Productivity and Openness in East Asia and Beyond Chong-En Bai, Dean of the School of Economics and Management, Tsinghua University | ||

| 9:50-10:20 | Coffee/Tea Break | ||

| 10:20-12:40 | Session 1: Boosting Productivity through Competition and Innovation: Experience from the PRC and Other Countries Presentation 1: Boosting Total Factor Productivity through Competition and Innovation: Experience of the PRC Bert Hofman, National University of Singapore, former Country Director of World Bank, PRC, and former Chief Economist for the World Bank in the East Asia and Pacific region Presentation 2: Australia’s Experience in Boosting Productivity and Competitiveness Catie Bradbear, Assistant Commissioner, Australian Productivity Commission Panel Discussion Moderator: Scott Morris, Vice-President (East and Southeast Asia, and the Pacific), ADB Panelists:

Q and A | ||

| 12:40-2:30 | Lunch break | ||

| 2:30-4:30 | Session 2: Expanding Economic Openness and Service Sector Liberalization in the PRC and Experience from Other Countries Presentation 1: Shamshad Akhtar, Chairperson of Board of Directors for Pakistan Stock Exchange; former Minister of Finance, Government of Pakistan; former Executive Secretary of UNESCAP Presentation 2: Opening the PRC’s Services Industry for Innovative and Shared Development Hildegunn Kyvik Nordås, Visiting Professor, Örebro University, Sweden; Senior Associate, Council on Economic Policies, Switzerland Panel Discussion Moderator: Justine Diokno-Sicat, Alternate Executive Director, ADB Panelists:

Q and A | ||

| 4:30-4:45 | Closing Remarks Shu Zhan, Alternate Executive Director, ADB | ||

| 4:45 onwards | Networking Reception |

| Date/Time | Session | ||

|---|---|---|---|

| 9:00-9:10 | Opening Remarks Muhammad Ehsan Khan, Director General, East Asia Department, ADB Zhan Shu, Alternate Executive Director, ADB | ||

| 9:10-10:10 | Session 1: What Experiences from the PRC Can be Learned and Replicated in the Region Presentation: Promoting AI Applications for High-Quality Development in the PRC Tongning Wu, Deputy Director Artificial Intelligence Research Institute China Academy of Information and Communications Technology Panel Discussion: Moderator: Aiming Zhou, Deputy Country Director, ADB PRC Resident Mission Panelists

| ||

| 10:10-10:30 | Tea Break | ||

| 10:30-11:30 | Session 2: How ADB Can Support DMCs with AI Application to Promote High-Quality Development Presentation: ADB’s Role in Promoting AI Application in the Region Albert Park, Chief Economist and Director General, Economic Research and Development Impact Department, ADB Panel Discussion: Moderator: Bobur Alimov, Advisor, EARD, ADB Panelists:

Q and A | ||

| 11:30-13:00 | Lunch break | ||

| 13:00-14:00 | Departure from the Kerry Hotel for site visit | ||

| 14:00-16:30 | Site visit: Beijing Innovation Center of Humanoid Robotics, Beijing High-level Autonomous Driving Demonstration (BJHAD) Zone Innovation and Operation Center, to experience the WeRide Autonomous Bus. | ||

| 16:30-17:30 | Return to the hotel |

© 2026 Regional Knowledge Sharing Initiative. The views expressed on this website are those of the authors and presenters and do not necessarily reflect the views and policies of the Asian Development Bank (ADB), its Board of Governors, or the governments they represent. ADB does not guarantee the accuracy of the data in any documents and materials posted on this website and accepts no responsibility for any consequence of their use. By making any designation of or reference to a particular territory or geographic area, or by using the term “country” in any documents posted on this website, ADB does not intend to make any judgments as to the legal or other status of any territory or area.